*Updated to reflect last night's signings of Mike Napoli by the Red Sox and Carlos Beltran by the Yankees.

We have all heard the talk of new money infusing the game of baseball, and early free agent spending seems to reflect that. The numbers on the recent run of free agent signings sound high, but what do they tell us about overall spending levels? A quick look reveals that, indeed, spending seems destined to rise significantly this year.

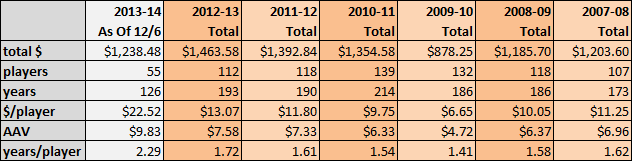

Working from the MLBTR Free Agent Tracker, and taking out the non-guaranteed deals and exercised options that are reflected in that database, MLB clubs have now committed nearly $1.24B to free agents for the 2013-14 signing period. (That number includes today's share of the binge, at least as of the moment of publication.) That money has gone to 55 players and guaranteed a total of 126 years. Teams have, to date, given out an average guarantee of $22.52MM per player at an average annual value of $9.83MM.

Let's try and put that in context. I have been hard at work compiling various information on spending over the 2007-08 through 2012-13 signing seasons. (There will be plenty more to come on that, so consider this a preview.) The results show that we could be looking ahead to some remarkable new levels.

Here are the total dollars committed by season through free agency over the last six, completed signing seasons, compared to the current one. Note that prior years include all free agent spending, while this year's figures are only as of today (in $MMs):

As these numbers show, the league is well on its way to shattering previous high free agent spending totals: current commitments are already just under 85% of last year's sum, but we have probably seen less than half of the MLB deals that ultimately will be signed. Indeed, at last look, only half of MLBTR's top fifty free agents have reached agreement so far.

Of course, the rate figures presented in the table will probably drop as the Robinson Cano and Jacoby Ellsbury deals are balanced out by smaller, shorter contracts. And it is doubtful that the other half of the market will command as much as the first half has. Indeed, as the table shows, the total number of years guaranteed through free agency has been fairly uniform. If that is any indication, teams may not be handing out all that many more multiyear deals, having already signed up to pay for 126 years to date; over 60% of the deals signed thus far have been for multiple seasons, an unsustainable level.

If we do a more apples-to-apples comparison, the multiyear deals we've seen thus far are also coming in above historical levels. Again, we might expect some regression here, but the initial returns are interesting to look at. Compared only to multiyear deals signed in past seasons, here is where the rates presently stand:

As this chart hints, there are some interesting similarities so far between this signing season and the 2007-08 period, which came before the global economic downturn. But that will have to remain a topic for another day. For now, while it is still too early to know where things will fall out, the total commitments per player and AAV numbers will be worth watching over the rest of the signing season.

And it is probably not too early to say that, at this point, it would be a considerable surprise not to see a sizeable jump in overall free agent spending levels when we ultimately look back on this signing season.