Back in January, I wrote an article in which I approximated the dollar value of the opt-out clauses in the contracts for David Price, Johnny Cueto, and Jason Heyward. Since then, five more contracts with opt-outs have been signed, so I have extended this analysis to put values on these opt-outs as well. These include contracts for Yoenis Cespedes, Justin Upton, Scott Kazmir, Ian Kennedy, and Wei-Yin Chen. Remember, these values are approximations of what these contracts would have cost without opt-outs. (Please reference the above-linked post for further explanation of the methodology.)

Too many people talk as though opt-outs are just bad decisions on the part of teams, without considering how much more expensive contracts would be without them. This logic would imply that no financial firm should ever sell a put—of course they should, but only at the right price.

The earlier three contracts were larger than almost all of the five more recent contracts. Other than Justin Upton, the other recent contracts were under $100 million, so the opt-out values are generally lower than the $17-22 million that I found for Price, Cueto, and Heyward. However, all five opt-out values all range between 10 and 15 percent of the full contract value, similar to the prior three deals.

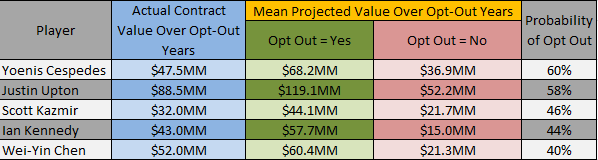

The following table shows the assumptions surrounding the opt-outs, like the one in January’s article. (Mobile app users can click here to see it.)

Yoenis Cespedes received a three-year contract for $75 million, but it is really a $27.5 million one-year contract with a player option of a two-year, $47.5 million deal. Few players actually sign one-year deals for that much money, but as we saw a decade ago with Roger Clemens, one-year deals for superstars have an AAV much higher than the AAV superstars receive on longer deals. In this case, Cespedes would probably have been worth about $31.7 million on a one-year deal. At this stage, a reasonable estimate of Cespedes’ value for 2017-18 would be around $55.1 million. However, like with all of these deals, we know that it is very likely that Cespedes’ market value will change significantly by next year. Chances are that if he is good enough to opt-out, then he will have had a strong 2016 campaign, and his market value will be higher. I estimate this would be around $68.2 million for 2017-18 in that case. If he does not opt-out, then he probably has disappointed in 2016 and probably has lowered his two-year value for 2017-18 down to $36.9 million. With an estimated 60% chance of opting out, that puts Cespedes’ opt-out at about $11.8 million. In other words, a regular three-year deal for Cespedes would be for $86.8 million instead of $75 million.

Justin Upton’s contract six-year, $132.5 million contract with the Tigers amounts to a two-year, $44.25 million deal with a four-year, $85 million player option. As a relatively young free agent, Upton has the potential to remain very valuable by the time he reaches his opt-out, but as a unique talent he is a risk to regress to the mean significantly—there is more room for him to fall than mediocre players. I estimate that if he has opted out after 2017, he has played well enough over 2016-17 that his market value will be about $119.1 million over 2018-21, and if he has not opted out then it stands to reason he has played poorly enough that his market value for 2018-21 would be about $52.2 million. Further, I estimate that he has a 58 percent chance to opt out. As a result, Upton’s opt-out is worth about $19.7 million, meaning that his value in a six-year deal without an opt-out would be $152.2 million.

Scott Kazmir had a relatively small deal for one that included an opt-out. His deal amounts to a $16 million one-year deal with $32 million two-year player option. I estimate that if he has opted out after this year, then he must have played well enough in 2016 that his market value for 2017-18 probably reached around $44.1 million. On the other hand, if he has played poorly enough that he does not opt out, then I estimate his market value for 2017-18 must have fallen to around $21.7 million. I think there is a 46 percent chance he opts out. As a result, his opt-out value is only worth $5 million—so a regular three-year deal without an opt-out would probably have been for about $53 million.

Ian Kennedy’s $70 million five-year contract is actually a $27 million two-year deal with a three-year, $43 million player option. His contract values him significantly higher than his Steamer or especially his ZiPS projection on FanGraphs would suggest, making it challenging to estimate his value. However, it is safe to assume that the Royals are placing more value on him than the projection systems and that they probably expect that his 2016 value is higher. Furthermore, there must have been at least some pressure for another team (real or imagined) that caused the Royals to believe they had to offer as much as they did. So we need to estimate the equivalent value of a contract based on the what the Royals paid, rather than what ZiPS or Steamer (and up to 28 other teams potentially) seem to think. Based on this, if he has opted out after 2017, then there is a good chance that the Royals (and potentially the other team they imagined themselves outbidding) were right about him, but if he does not then there is a good chance the projection systems were right. I estimate that his value over 2018-20 would only be $15 million conditional on not opting out, while it would be about $57.7 million if he played well enough to justify opting out. I think the Royals estimate a 44 percent chance that he will opt out (again, another team bidding presumably thought something similar), making his opt-out value about $7.1 million. A five-year deal without an opt-out would probably be worth about $77.1 million.

Wei-Yin Chen has a tricky deal. Nominally he has a 5 year deal worth $80 million, but it is really a $28 million deal over two years, with a player option for $52 million over the following three years. However, if he does not opt out, then the team has an option for 2021 that will actually vest if he pitches a sufficient number of innings and is healthy. Putting a value on a vesting option that is conditional on having a low value after 2017 is tricky, but I believe I have come up with a reasonable estimate. I think that if he does opt out, his value for 2018-20 is probably about $60.4 million, while his conditional value if he plays poorly enough to not opt out would be $21.3 million over 2018-20. His vesting option at the end is essentially worth under $2 million to the team. I think that on a normal five-year contract for 2016-20, Chen would have gotten about $82 million, which means his opt-out value was about $12 million.

As these deals become more common, it becomes more important to properly value these put options. I estimate that these five deals would each have cost about 10 to 15 percent more for teams if they did not provide the players with opt-out clauses. Players with more years post opt-out and higher talent levels will generally have a larger value to opting out, while the inverse is true for players with fewer years post opt-out who are less talented. While these opt-outs are risky, they definitely provide an opportunity for teams to save money relative to mutually guaranteed longer contracts.

Very niece piece, well reasoned and presented.

One of the less likely but possible risks in the opt-out is on the short end–JD Drew’s contract with the Dodger. He had a spectacular year with the Braves in 2004, signed a five year deal with the Dodgers with an opt-out after the second year. In 2005, he was injured and played only 72 games for them, then had a very good full season in 2006, and opted out for a five year deal with the Red Sox. Dodgers were not happy,

Genius! All those numbers in a filter that actually make all the sense in the world! I like the opt out clause for more reasons than the obvious. Players get to act like real free agents since free agency has almost been taken away by the Qualifying offer.

How did you come up with the percent chance that each would opt out after this year? That seems like a pretty key value, but it’s not clear where it comes from.

This seems to lose merit when you get to Kennedy and decide that you should measure different players by different metrics because you want to. Don’t get how it’s not totally arbitrary.

Also, where do you get the two-year, $27m figure for Kennedy? Baseball-reference has it at two for $21m, which makes a lot more sense. The point of the Kennedy deal always seemed to be that the Royals felt they needed an at least average pitcher for the next two years, but couldn’t immediately afford what this year’s market was dictating, what with their high payrolls this year and next, which is why they so severely backloaded it. By -reference, they are paying him less than ten mill this year, which totally makes sense.

So if Chen feels he can not beat a 3 year $52m contract by opting out ($17.3ish AAV) and Kennedy feels he can not beat a 3 year $43m contract by opting out then they only hold values of around $7m per year for Chen and $5m per year for Kennedy? That would pretty much mean that each player has become a Chris Capuano type player. Seeing as even mediocre starting pitchers are routinely signing 1 year contracts between $8-$10 million its hard to imagine both of these guys falling off an absolute cliff to where they are only worth $5-$7 million per year.. Besides, have you seen the 2018 free agent class? It is not out of the realm of possibility that each of these pitchers feels having guaranteed contracts into their mid 30’s as a positive thing. Rather than throwing caution to the wind in a deep free agent class in the hopes of achieving slightly more money. Your formula is logical for higher earning and younger players like Upton and Heyward. But, you are lacking in several variables when it comes to mid tier players. Kennedy alone valued at only $5m per even in an off year is laughable. His ability to eat innings and maintain an FIP between 3.75 and 4.50 makes him worth well over that.

As a Tigers fan, the bottom line is that it is a WIn/Win deal. Getting a high probability of 2 prime years for a reasonable price is a no brainer.

Then he takes the opt out just as he is ending his prime years and the Tigers get a good draft pick and money freed up to use on another 28 year old guy or maybe they win a championship and break up the team with cheap, young guys at that time.

I would say that opt out is worth about $20MM to the TIGERS (not just Upton). What am I missing?

You are missing that Justin Upton could be terrible or injured the next 2 years and the Tigers are on the hook for the remainder of the contract.

The risk with opt-outs is that the player is only going to stay if he is not worth the remaining dollars left on the contract.

These are huge risks for the team with zero risk for the player.

The deal is an insurance policy for the player.

But the team can take out a real policy too.

The risk seems low at this point. Let us see what happens.

My main point is that a favorable outcome (which is almost 60% probability according to the article) is positive for BOTH parties. It is a GOOD THING if Upton opts out before he leaves his prime years.

Yes, the only way this is a good deal for the Tigers is if Upton opts-out. If he continues being the Justin Upton we know, that’s what he’ll do. Then if the Tigers are smart they will let him walk.

But baseball is a funny game. Players fall off a cliff all of the time. If he turns out like his brother, the Tigers are sitting on one of the worst contracts in baseball.

My point is, it is definitely not a win-win scenario. It’s not that far-fetched that the Tigers could be regretting this deal badly in a few years.

My understanding is that Upton wanted 7 or even 8 years. The Tigers counter offer was the opt out. Tigers come out ahead either way from that standpoint, based on what it would have taken to sign him.

Ok Tigers come out ahead, sure. Haha

I don’t know how you don’t see that opt-outs are ONLY good for the player. Just as a team option is ONLY good for the team.

Except that opt outs/options get the deal signed. Typically a player can get more money if he agrees to an option for the team, and as noted in the article a team can pay less if they agree to an opt out.

It gives the other side some power to get the dollar figures where they want it to be.

Yes in exchange for assuming extra risk in the contract.

Bottom line:

The Tigers got Upton for BELOW projections because of the Opt out.