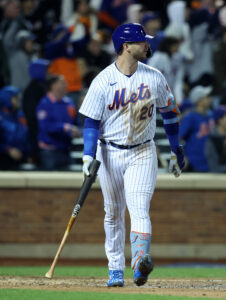

The Mets hammered out a multi-year deal with one of their top arbitration-eligible players two weeks ago, guaranteeing Jeff McNeil $50MM to extend their window of control by as much as three seasons. General manager Billy Eppler predictably expressed openness to more deals of that nature. Of the other players on the roster, slugger Pete Alonso stands out as the most obvious candidate.

Alonso would certainly cost more than McNeil. He’s already racked up far greater earnings via the arbitration process and he’s nearly three years younger than his infield mate. While they’re each in the same service window — between four and five years of MLB time — Alonso’s in position to cash in to a much greater extent. If discussions between the Mets and his representatives at Apex Baseball get underway, there’s one obvious recent precedent to kick off discussions: division rival Matt Olson.

Within one day of acquiring Olson from the Athletics last spring, the Braves signed him to an eight-year, $162MM guarantee. The deal also came with what looks to be an affordable club option for a ninth season, an almost universal feature in Atlanta’s pre-free agency extensions. Olson’s nine months older than Alonso; he was entering his age-28 campaign last spring, as the Met is now. They obviously play the same position. Olson was in the same 4-5 year service bucket in which Alonso now finds himself, making for a direct comparison.

How do they align as players? Olson had a down season by his standards during his first year with Atlanta. The Braves couldn’t have known that at the time of his extension, however, so any comparison between the two has to isolate Olson’s production through 2021. At that time, he carried a career .252/.348/.511 line in just under 2400 plate appearances — offense that wRC+ calculated as 32 percentage points above league average after accounting for Oakland’s cavernous ballpark. Alonso has a bit under 2300 career trips to the dish and owns a .261/.349/.535 mark, with that production measured 38 points above par. The latter has a slight edge in power production, hitting home runs in around 6.47% of his career plate appearances against Olson’s nearly even 6% rate through 2021.

The power gap probably isn’t as significant as one might expect given Alonso’s status as a two-time Home Run Derby champion and his MLB-best 53 longballs as a rookie, though. Olson makes hard contact more consistently and hits the ball harder on average than Alonso does. Alonso has been a little better at translating his hard contact into home runs, though they’re each clearly elite power threats.

Both hitters have roughly average bat-to-ball skills. Olson carried a career 23.4% strikeout rate into the 2022 season; Alonso has fanned in 22.1% of his trips to the plate. Olson has a patient approach that gives him a slight edge in walks but it’s again a small gap. There’s also very little difference in their performance the year before hypothetical extension talks. Olson hit .271/.371/.540 with 39 homers and a 16.8% strikeout rate in 2021. Alonso’s coming off a .271/.352/.518 showing with 40 longballs and an 18.7% strikeout percentage. His on-base and slugging marks are a little behind Olson’s from the previous season, though that’s largely explainable by the league drop in offense last year. As measured by wRC+, Alonso’s offensive production was 43 points above par while Olson was 47 points better than average in ’21 — again, a minimal distinction.

Given their similarities as hitters, the Olson deal works as a strong starting point for gauging the terms it might take to keep Alonso. Olson has the advantage as a defender. He’s a two-time Gold Glove winner who’d gotten above-average grades from public metrics throughout his career, with Defensive Runs Saved crediting him as +34 runs compared to an average first base defender throughout his time in Oakland. Alonso’s glove isn’t as poor as some evaluators had worried during his prospect days, though public metrics paint him as a slightly below-average first baseman. He’s playable but doesn’t add the kind of value there Olson does.

There’s a reasonable debate as to whether Olson’s superior glove negates Alonso’s slight advantage as a power bat and makes him the better overall player. Alonso has a few financial advantages that might tip the scale in his favor in extension negotiations, however.

Alonso was in a better spot with regards to his final two arbitration years. He and the Mets have already agreed to a $14.5MM salary for the upcoming season; Olson had been projected by MLBTR contributor Matt Swartz for a $12MM salary for his second-to-last arbitration year. Considering those salaries escalate year-over-year based in large part on a player’s previous salary, Alonso likely would’ve had a similar edge for their final arbitration seasons. It’s not a huge difference but Alonso would likely have earned around $5-6MM more over his final two arbitration campaigns than Olson would have.

That’s not a factor for the would-be free agent years. Olson will be paid $22MM annually for the six free agent seasons he signed away. Considering Alonso’s a comparatively valuable all-around player, that’s a reasonable starting point. However, Alonso’s camp could get an edge from the spike in spending on star talent from this offseason. The best free agents generally surpassed market expectations. Rafael Devers, meanwhile, signed an extension that pays him $31.35MM for ten free agent seasons (though deferrals knocked its actual value to around $29.15MM).

Alonso isn’t likely to get to Devers money. The Red Sox slugger is two years younger, was a season closer to free agency and has more defensive value in his ability to play third base, at least in the short term. Still, the Devers deal is illustrative of the top of the market pushing up in the past 12 months — last spring, the Red Sox were reportedly pointing to Olson money as a comparable factor in talks with Devers but eventually went way beyond that — and Alonso’s camp could reasonably look for something a bit above the Olson average annual value in talks this spring.

It’s also at least worth considering how hard a bargain the Mets might try to drive in negotiations. Owner Steve Cohen and the front office have shown more willingness than any team the past two years to meet lofty asking prices to add star talent. That’s not universal (see: Jacob deGrom) but the Mets haven’t shown much fear of spending, even in the face of an astronomical luxury tax bill. The Braves have a high payroll but not one wildly different from the rest of the league, and this Atlanta front office has shown a knack for extending players at rates many outside observers find at or below market.

There’s room to tinker on the margins, likely to give Alonso the edge, though the Olson deal should be a starting point in any negotiations. Speculatively speaking, perhaps something in the range of eight years and $180.5MM (including this season’s $14.5MM salary) could be mutually agreeable. That’d tack on $166MM in new money for Alonso’s final arbitration season and six free agent years, running through his age-35 campaign. Estimating his final arbitration year around $22MM, it’d represent a $24MM average annual value for the six would-be free agent seasons. Alonso would move the extension market past a similar player in Olson, while the Mets would be able to keep another star in Queens for the foreseeable future.

Image courtesy of USA Today Sports.